Here is a step-by-step guide on choosing a supplier, pricing, quality control, delivery, customs clearance, and compliance requirements for importing solar panels from China to the United States or other markets.

Research and supplier selection

Some platforms to source suppliers:

- Alibaba (Verify “Gold Suppliers” with Trade Assurance)

- Made-in-China

- Global Sources

- Factory Visits (Best for large orders)

Red Flags to Avoid

- No business license or factory certifications.

- Unwillingness to provide samples.

- Prices significantly lower than market average.

Verify Supplier Credentials

- Certifications: ISO 9001, TÜV, IEC 61215/61730 (solar panel standards).

- Audit Reports: Request third-party inspections (e.g., SGS, BV).

- Past Clients: Ask for references from U.S./EU buyers.

Negotiating prices and terms

Pricing Factors and price impact:

- Panel Type – Monocrystalline ($0.25–$0.40/W) > Polycrystalline ($0.20–$0.30/W)

- Order Volume -10%–30% discount for 1MW+ orders

- Incoterms – FOB (buyer handles shipping) vs CIF (seller arranges shipping)

Quality control and inspections

What to Check:

- Efficiency.

- Defects (micro-cracks, hot spots).

- Packaging (weatherproof, palletized).

Shipping and logistics

The list of key documents for shipping:

- Commercial Invoice

- Packing List

- Bill of Lading

- Certificate of Origin (For duty savings)

Shipping Methods Compared

| Method | Cost | Transit Time | Best For |

| Air Freight | $5–$10/kg | 3–7 days | Urgent, small orders |

| FCL Ocean | $3,000–$6,000/container | 25–35 days | Large orders |

| LCL Ocean | $800–$1,500 | 25–35 days | Medium orders |

Common challenges and decisions

Supplier fraud – Use Alibaba Trade Assurance, request samples

Shipping delays – Book 4+ weeks early

Customs holds – Ensure UL certification, proper HS code

Defective panels – Negotiate warranty (10–25 years)

U.S. customs and import regulations

Tariffs and duties for importing solar panels from China (2024)

Current U.S. Tariffs

- Section 301 Tariffs: 15% on most Chinese solar panels (HS Code 8541.40.60).

- Bifacial Solar Panels: Exempt (0% duty as of 2024).

- Section 201 Safeguard Tariff: Expired in Feb 2022 (no longer applies).

Additional Fees

- Merchandise Processing Fee (MPF): 0.3464% of shipment value (min $27.23, max $538.40).

- Harbor Maintenance Fee (HMF): 0.125% (for ocean shipments only).

Duty Avoidance Strategies

- Import from tariff-exempt countries (Vietnam, Malaysia, Thailand).

- Use Foreign Trade Zones (FTZs) to defer duties.

- Verify if bifacial panels qualify for 0% duty.

Customs Clearance Process

- File ISF (Importer Security Filing) 24+ hours before arrival.

- Submit ACE Entry via a customs broker (~$100–$300).

- Pay Duties & Fees (MPF: 0.3464% of value).

- FDA/USDA Clearance (Not usually required for solar).

The list of cost factors and amount:

- Panels (FOB China) $250,000

- Ocean Shipping (FCL) $5,000

- Import Duty (15%) $37,500

- Customs Broker $300

- Warehousing (1 month) $2,000

- Total Landed Cost $294,800

Best Practices for Success

- Start with a trial order (10–50 panels).

- Use a freight forwarder for door-to-door service.

- Demand IEC/UL test reports before final payment.

- Monitor U.S. tariff updates via USTR.

Types of Solar Panels: A Detailed Overview

Monocrystalline Solar Panels

Appearance: Black, uniform cells with rounded edges

Efficiency: 20-24% (Highest available)

Lifespan: 25-40 years

Cost: $0.25–$0.40

Advantages

- Highest efficiency (best for small roofs)

- Best heat tolerance (lose less power in heat)

- Sleek black aesthetic

Disadvantages

- Most expensive panel type

- Slight efficiency drop in low light

Best For:

- Commercial projects with space limits

- Roofs of residential buildings

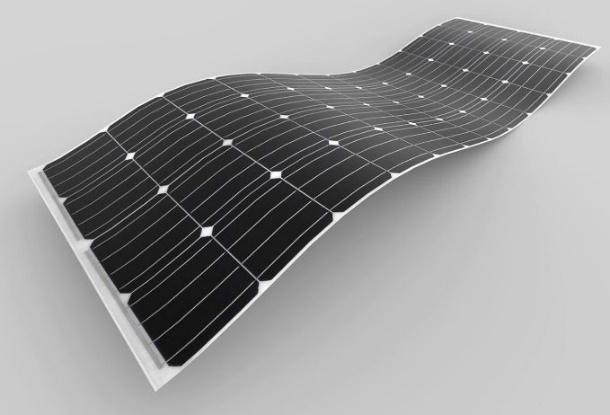

Image of monocrystalline solar panel:

Polycrystalline Solar Panels

Appearance: Blue, speckled cells with square edges

Efficiency: 15-20%

Lifespan: 20-35 years

Cost: $0.20–$0.30

Advantages

- 10-15% cheaper than monocrystalline

- Simple manufacturing = lower carbon footprint

Disadvantages

- Lower efficiency (need more space)

- Poorer heat tolerance (lose more power on hot days)

Best For:

- Large-scale solar farms

- Budget residential installations

- DIY solar projects

Image of polycrystalline solar Panel:

Thin-Film Solar Panels

Appearance: Ultra-thin, flexible black sheets

Efficiency: 10-13% (Lowest of the three)

Lifespan: 10-20 years

Cost: $0.15–$0.25

Advantages

- Lightweight and flexible

- Best performance in low light/clouds

- Lowest production cost

Disadvantages

- It decomposes 2-3 times faster than crystal panels

- It requires 2 times more space to achieve the same performance

Best For:

- RVs, boats and mobile applications

- Industrial rooftops (weight-sensitive)

- Temporary solar setups

Image of Thin-Film solar panels:

Understanding solar panel specifications

You need to understand solar panel specifications is crucial for selecting the right system. Below you can see a key specs, how they impact performance, and what to look for when buying.

Technical Specifications

- Wattage (W): Max output (350W-450W residential). Defines system size.

- Efficiency (%): Sunlight conversion (15-24%). Higher = more power in less space.

- Temp Coefficient (%/°C): Power loss when hot (-0.3% to -0.5%/°C). Critical for warm climates.

- Voltage (V) & Current (A): Must match inverter/battery (Voc, Vmp, Isc, Imp).

- Tolerance (%): Prefer 0/+3% or 0/+5% for guaranteed performance.

- NOCT (°C): Real-world operating temp (40-50°C). More accurate than lab tests.

- Size & Weight: Affects roof space and load capacity.

Cost Factors (China Imports)

- Materials: Polysilicon (~40% cost), silver, aluminum, glass.

- Manufacturing: Cheaper labor ($2.50-$4.50/hr) and energy ($0.07-$0.10/kWh).

Shipping

- Air: $0.08-$0.12/W (3-7 days).

- Ocean: $0.01-$0.04/W (30-45 days).

- MOQ: 1 container (~500 panels) for best pricing ($0.20-$0.32/W).

Tariffs & Savings

- US: 15-40% duties (bifacial exempt).

- EU: 0% duty but strict traceability.

- India: 40% on panels (often routed via Vietnam).

- Savings Tips: Bifacial panels, ASEAN sourcing, hybrid shipping.

Common Quality Issues and Solutions

| Problem | Detection method | Prevention |

| Microcracks | EL imaging | Demand cell-level inspection |

| Delamination | Visual + damp heat test | Verify EVA encapsulation quality |

| PID Effect | 96hr PID test | Buy PID-resistant panels |

| Label Fraud | Flash test at 25°C | Third-party certification |

Step quality assurance process

Factory Audits (Before Ordering)

What to verify:

- Production capacity (avoid “paper factories”)

- Raw material sources (trace polysilicon origin)

- Testing equipment (EL testers, flash testers)

Audit checklist:

- ISO 9001 certification

- In-house IV curve tester

- Laminator temperature logs

Cost: $800-$2,000 per audit (worthwhile for orders >$50k)

Pre-Shipment Inspection (PSI)

Conducted when 80% packed:

Visual inspection: Cell cracks, busbar alignment

Electrical testing:

- Power output (flash test vs datasheet)

- Insulation resistance

Packaging check: Pallet stacking, waterproofing

Arrival Inspection

Re-test 2-3% of panels at destination

Compare with PSI results (catch shipping damage)

Smart supplier qualification

- Request test reports from accredited labs (TÜV, UL, CSA)

- Verify certification validity on official databases

- Start with sample order (10+ panels for real-world testing)

- Include penalties in contracts for failed inspections

Shipping and Logistics for Solar Panel Imports

Solar panels require specialized packaging to prevent damage during transit:

Standard Packaging Methods

- Wooden crates (most secure)

- Stack limit: 28-32 panels per pallet

- Edge protectors on all corners

- Waterproof wrapping (essential for ocean freight)

Critical specs:

- Stacking weight limit

- Vibration testing: Must withstand 1.5G forces

- Humidity control

Insurance Requirements

Solar panels are classified as fragile cargo requiring special coverage:

Standard coverage: 110% of commercial value

Special clauses needed:

- Breakage coverage (standard policies often exclude)

- Temperature extremes (for desert routes)

- Freshwater damage (not just seawater)

Customs Clearance Process

Documents required:

- Commercial Invoice (with HS code 8541.40.60)

- Packing List (detailed panel counts per pallet)

- Bill of Lading (original + 3 copies)

- Certificate of Origin (for duty reduction)

- UL/IEC Certificates (mandatory for release)

Clearance Timeline:

US: 2-3 days (FDA may inspect)

EU: 1-2 days (CE mark required)

India: 7-10 days (BIS certification needed)

2024 Shipping cost example

| Cost component | FCL Ocean | Air Freight |

| Factory to port | $800 | $1,200 |

| Ocean/air freight | $18,000 | $85,000 |

| Insurance (1.1%) | $220 | $935 |

| Customs clearance | $300 | $300 |

| Port to site | $2,500 | $1,800 |

| Total | $21,820 | $89,235 |

Emerging Alternatives

Nearshoring

Chinese brands now producing in:

- Mexico (for US market)

- Turkey (for EU market)

Adds 5-8% to unit cost but saves 20% on logistics

Blockchain tracking

Real-time monitoring of:

- Container humidity

- Shock events

- Temperature extremes

Available via Maersk+IBM TradeLens

Importing solar panels from India: A viable alternative?

Cost Comparison

| Factor | India | China |

| Base Panel Cost | $0.28-$0.35/W | $0.20-$0.28/W |

| Shipping to US | $0.04-$0.06/W | $0.02-$0.04/W |

| US Tariffs | 0% (No Section 201) | 15-25% (Section 201/301) |

| Total Landed Cost | $0.32-$0.41/W | $0.25-$0.38/W |

Shipping and lead times

| Route | India to US West Coast | China to US West Coast |

| Ocean Transit | 35-50 days | 18-25 days |

| Customs Clearance | 3-5 days (FDA review) | 2-3 days |

| Port Options | Mundra, Chennai | Shanghai, Ningbo |

If you wondering why buyers are diversifying to India here are some reasons:

Geopolitical Factors

US-China tensions: Section 301 tariffs likely to increase

UFLPA risks: Xinjiang polysilicon documentation challenges

IP theft concerns: Some Chinese suppliers replicating designs

Policy Advantages

ALMM List (India): Mandates for government projects driving quality

PLI Scheme: $3.2B in Indian manufacturing incentives

No forced labor scrutiny: Unlike China’s Xinjiang region

Emerging Indian Advantages

English proficiency (easier contracts/QC communication)

Common law legal system (familiar to Western buyers)

Time zone alignment with Europe/Middle East

When India makes sense and when it doesn’t:

Choose India When:

- You need tariff-free access to US/EU markets

- Your project has social responsibility requirements

- You’re serving price-sensitive markets (Africa, Middle East)

Choose China When:

- You need cutting-edge tech

- You’re importing bifacial panels (India lags in production)

- It takes less than 30 days to complete your order

Step-by-Step sourcing process from India

- Verify ALMM Registration (for Indian suppliers)

- Audit factory (focus on cell sourcing – many import from China)

- Negotiate (10-15% discounts common for 1MW+ orders)

- Pre-shipment EL testing (mandatory – Indian QC varies widely)

- Use Mundra Port (most efficient for solar exports)

Importing Solar Panels from Other Countries: Germany, Vietnam, etc.

Germany/EU: Premium Quality at a Price

- No anti-dumping duties in Western markets

- Best temperature coefficients (-0.26%/°C avg)

- Carbon-neutral manufacturing (Key for ESG projects)

- Cost: $0.45-$0.65/W (2-3× China’s price)

- Lead Time: 6-8 weeks (vs Asia’s 4-6)

- Warranty: 15-25 years (industry’s longest)

Best For: High-end residential/commercial projects where quality trumps cost.

Vietnam: The Rising Challenger to China

- Avoids US tariffs (No Section 201/301 duties)

- Faster shipping than India

- Growing Tier-1 presence

- Cost: $0.23-$0.30/W (FOB)

- Efficiency: 20-22%

- Export Volume: #2 to US after China (8.4GW in 2023)

Watch For:

- Transshipment risks – Some Chinese panels are relabeled

- Limited HJT/TOPCon production – Mostly PERC tech

Best For: Buyers needing China-quality panels without tariffs.

South Korea: Tech Leader for Niche Markets

- Best bifacial panels (30%+ energy gain vs 20% standard)

- Qcells dominance – 5.1GW US factory by 2024

- USMCA-friendly – No tariffs if assembled in Mexico

- Cost: $0.35-$0.50/W

- Tech Edge: Qcells’ Q.ANTUM DUO (23.1% efficiency)

- Shipping: 12 days to California

Best For: Utility-scale projects needing high-durability bifacial panels.

Malaysia/Thailand: The Stealth Alternatives

- Mature supply chains

- Lower labor costs than China (by 15-20%)

- Avoids Xinjiang scrutiny (Polysilicon sourced elsewhere)

- Cost: $0.25-$0.33/W

- Lead Time: 21-28 days to US

- Certifications: Full UL/IEC compliance

Turkey

- Duty-free access to EU

- Rapid growth – 8GW production capacity in 2024

- Balanced pricing – 10-15% cheaper than EU-made

- Cost: $0.30-$0.40/W

- Shipping to EU: 3-5 days

- Specialty: Frameless BIPV panels

Best For: European installers needing fast deliveries without China risks.

Mexico

- USMCA tariff-free access

- 2-week delivery to US job sites

- Chinese brands on-site (Jinko, JA Solar factories)

- Cost: $0.32-$0.42/W

- Capacity: 7GW+ by 2025

- Logistics Edge: Delivery by truck to US in less than 72 hours

Best For: US buyers needing rapid replenishment inventory.

What are the rules and regulations for importing solar panels?

U.S. Import Regulations

Tariffs and Trade Policies

Section 201 Safeguard Tariff:

- 15% on most crystalline silicon solar panels (HS Code 8541.40.6020)

- Exemption: Bifacial solar panels (currently 0% tariff)

Section 301 Tariff:

- 25% on inverters and some components (but typically not panels)

Uyghur Forced Labor Prevention Act (UFLPA):

- Requires documentation proving no Xinjiang polysilicon in supply chain

- Detentions common without traceability audits

Certifications Required

- UL 1703 (Mandatory safety standard)

- IEC 61215/61730 (Int’l performance/safety standards)

- FCC Part 15 (Electromagnetic compliance)

- California Energy Commission (CEC) Listing (For CA projects)

Customs Documentation

- Commercial Invoice (With detailed HS code)

- Packing List

- Bill of Lading

- Certificate of Origin (For USMCA/other FTA claims)

- UL/IEC Test Reports

European Union Regulations

Key Requirements

- CE Marking (Including EN 61730/61215)

- REACH Compliance (Chemical restrictions)

- WEEE Registration (Recycling compliance)

- No Anti-Dumping Duties (But strict enforcement of customs valuation)

Other Major Markets

India

Basic Customs Duty (BCD):

- 40% on solar panels

- 25% on solar cells

ALMM List: Must source from approved manufacturers

Australia

No tariffs but requires:

- IEC 61215/61730

- CEC Approval

Brazil

- INMETRO Certification (Mandatory)

- 14.2% Import Tax

Potential Delays and Solutions

| Challenge | Decision |

| Missing UL Certificates | Request from supplier before shipping |

| UFLPA Detention | Provide supply chain audit reports |

| Incorrect HS Code | Use 8541.40.6020 for crystalline silicon |

| Port Congestion | Book PierPass appointments early |

Clearance Process

Pre-Arrival

- File Importer Security Filing (ISF-10) via ACE portal

- Submit FDA Prior Notice (if applicable)

Entry Submission

- Customs broker files CBP Form 3461

- Pay 15% tariff (unless bifacial or exempt)

Examination Risk

- FDA Inspection: Checks for UL compliance (common for solar)

- UFLPA Review: Polysilicon sourcing documentation

Choosing the Right Solar Panel Manufacturer: Key Considerations

Selecting a reliable solar panel manufacturer is very important for performance, longevity, and return on investment.

Certifications and Compliance

Verify these non-negotiable certifications:

- UL 1703 (U.S. safety standard)

- IEC 61215/61730 (Performance/safety testing)

- CEC Listing (For California projects)

- UFLPA Compliance (For U.S. imports)

Red Flags:

- Suppliers offering “self-certified” test reports.

- No traceability for polysilicon sourcing.

Manufacturing Transparency

Audit These:

- Factory tours (Virtual/in-person)

- Raw material sourcing (Polysilicon, silver paste)

- Production QC processes (EL testing, lamination)

Ask For:

- ISO 9001/14001 certifications

- Third-party inspection reports (SGS, TÜV)

Warranty and Degradation

Compare:

- Product Warranty: 10–15 years

Performance Warranty:

- 90% output at 10 years

- 80% at 25 years

Financial Stability

Check:

Bankability Ratings

Recent financial reports (Avoid firms with >80% debt ratios)

It matters because it ensures that they’ll honor warranties long-term.

Regional Considerations

For U.S. Buyers: Prioritize Vietnam/Malaysia to avoid tariffs.

For EU Buyers: Choose Turkey/Germany for faster delivery.

For Emerging Markets: Indian manufacturers (Waaree, Adani) offer cost savings.

FAQ: Importing Solar Panels from China

Q: What certifications are required?

Q: What’s the cheapest shipping method?

Q: How do I verify supplier quality?

Q: Can I import tariff-free from China?

Q: What are common pitfalls?

Resources for Solar Panel Importers

Here’s a list of some resources for solar panel importers:

- https://www.cbp.gov/trade/priority-issues/energy/solar

- https://hts.usitc.gov

- https://productiq.ulprospector.com/en

- https://www.certipedia.com

- https://about.bnef.com/solar-pv-market-intelligence/

- https://www.cbp.gov/trade/forced-labor/UFLPA

- https://www.freightos.com/freight-resources/freight-calculator

- https://seia.org

- https://www.globalsolarcouncil.org

- https://www.pv-magazine.com/2019/02/22/markets-started-to-embrace-non-conventional-modules-in-2h-2018/

- https://www.exim.gov