In the global tea trade changes often occur significant transformation due to climate change, economic shifts, and evolving consumer preferences. Below is an analysis of the market, key players, and future projections.

Top importers

- United States ($2.8B) – Largest importer of specialty teas (matcha, herbal).

- Russia ($1.5B) – Dominates black tea imports.

- UK ($1.2B) – High demand for premium blends.

- Pakistan ($700M) – Major consumer of bulk black tea.

- Germany ($600M) – Leading organic tea importer.

Top exporters

- China ($2.1B) – Green, oolong, white teas.

- India ($1.8B) – Black tea (Assam, Darjeeling).

- Kenya ($1.3B) – Budget-friendly black tea.

- Sri Lanka ($1B) – Ceylon tea.

- Vietnam ($500M) – Emerging as a low-cost producer.

Here’s some key trends shaping tea imports in 2025

The global tea market is undergoing significant shifts in 2025. Climate change is disrupting traditional production hubs – Assam’s yields have dropped 15% due to erratic monsoons, while Kenyan growers face drought-related cost increases. This is pushing production to more stable regions like Nepal and Vietnam, though even China’s Yunnan province struggles with soil degradation.

Economic pressures are mounting across the supply chain. Shipping costs have jumped 30% due to Red Sea disruptions, and major producers like India and Sri Lanka face labor shortages. Trade policies continue to reshape flows – the U.S. maintains 25% tariffs on Chinese tea, boosting Indian and Kenyan imports, while UK’s post-Brexit scheme gives African producers tariff-free access.

Consumer preferences are driving innovation. Health-focused varieties like matcha and herbal teas (hibiscus, turmeric) see 20% demand growth, with organic certification becoming table stakes in Western markets. Sustainability concerns now impact logistics (carbon-neutral shipping) and packaging (EU’s plastic-free rules). At the premium end, single-origin teas like Darjeeling First Flush command 50%+ price premiums as buyers increasingly value traceability and quality.

Below you can see the table of major players in the tea import market

| Company | Role | Key Markets |

| Unilever (Lipton) | Largest tea brand (25% global share). | U.S., Europe, Middle East |

| Tata Consumer Products | Major India-based exporter (Tetley). | UK, U.S., Canada |

| Starbucks | Drives premium tea trends. | U.S., China |

| Yorkshire Tea | UK’s favorite blend. | Europe, Australia |

| ITO EN | Japan’s top green tea exporter. | U.S., Asia |

Future outlook and challenges:

Opportunities:

- Africa’s Rise: Kenya, Malawi, Rwanda expanding production.

- E-Commerce Growth: Alibaba, Amazon, and specialty DTC brands (e.g., Vahdam) boosting accessibility.

- Functional Teas: CBD-infused, adaptogenic blends gaining traction.

Risks:

- Supply Chain Fragility: Geopolitical tensions (e.g., Red Sea) disrupt shipments.

- Regulatory Hurdles: Stricter EU/U.S. pesticide bans (e.g., neonicotinoids).

- Climate Volatility: Long-term threat to traditional tea-growing regions.

Tea imports by country: A comprehensive overview

Here’s a focused analysis of the top tea importing countries for 2025.

| Country | Import Value (USD) | Key Tea Types Imported | Growth Trend | Top Suppliers | Key Regulations |

| United States | $2.8 billion | Matcha (40% growth), Herbal, Premium Black | +6% YoY | Japan, India, China | FDA food facility registration, 25% China tariff |

| Russia | $1.5 billion | CTC Black (85% share), Fruit Blends | Stable | India, Sri Lanka, Kenya | GOST-R certification required |

| United Kingdom | $1.2 billion | Earl Grey, Breakfast Blends, Organic | +3% YoY | Kenya, India, Malawi | UKCA labeling post-Brexit |

| Pakistan | $700 million | Strong Black CTC (90% share) | +5% YoY | Kenya, Rwanda | Halal certification preferred |

| Germany | $600 million | Organic (30% market), Herbal, Green | +8% YoY | China, Sri Lanka | EU Organic Certification required |

| Japan | $550 million | Oolong, Pu-erh, Specialty Blends | +4% YoY | China, India | JAS Organic standards |

| Iran | $500 million | Black CTC, Traditional Blends | Stable | Sri Lanka, India | Sanctions-compliant payments |

| Canada | $450 million | Matcha, Wellness Blends, Iced Tea | +7% YoY | China, Japan, India | Bilingual (EN/FR) labeling |

| France | $400 million | Luxury Blends, Flavored Teas | +5% YoY | China, Sri Lanka | EU Novel Food compliance |

| UAE | $380 million | Premium Black, Herbal Infusions | +9% YoY | India, Kenya, Sri Lanka | Halal certification required |

Data Insight:

- The U.S. leads in specialty teas (matcha, wellness blends).

- Russia & Pakistan dominate bulk black tea imports.

- Germany drives organic demand (30% of EU organic tea imports).

Top 5 tea exporting countries (2025)

| Country | Export Value (USD) | Key Tea Types Exported | Top Buyers |

| China | $2.1B | Green, Oolong, White | U.S., Japan, Germany |

| India | $1.8B | Black (Assam, Darjeeling) | Russia, UK, UAE |

| Kenya | $1.3B | Black (CTC) | Pakistan, UK, Egypt |

| Sri Lanka | $1B | Ceylon Black, Green | Russia, Turkey, Iran |

| Vietnam | $500M | Green, Jasmine | U.S., Taiwan, Poland |

Data Insight:

- China dominates premium teas (Longjing, Tieguanyin).

- Kenya supplies 60% of Pakistan’s tea.

- Vietnam is the fastest-growing exporter (+12% YoY).

Country-Specific import regulations

United States

FDA Requirements:

Prior Notice Submission (for FDA-regulated teas).

Labeling: Ingredients, net weight, importer details.

Duties:

0% for black/green tea (HTS 0902).

25% tariff on Chinese teas (Section 301).

European Union

Strict MRLs (Pesticide Limits): EU 396/2005 regulation.

Organic Certification: Mandatory for “organic” labeling (EU 2018/848).

VAT: 5–27% (varies by country).

China

Customs Inspections: Heavy metal testing (lead, cadmium).

Green Standards: “Organic” requires CNCA certification.

Trade Shifts:

- U.S. buyers avoid Chinese tea due to tariffs (switch to Vietnam/Japan).

- UK diversifies from Kenya to Malawi/Rwanda post-Brexit.

Tech-Driven Farming: AI-based pest control in Sri Lanka.

Best selling teas: Global favorites Emerging trends

The global tea market is evolving rapidly, driven by health consciousness, sustainability concerns, and premiumization. Below you can see an analysis of the most popular tea varieties, regional preferences, and emerging trends shaping the industry in 2025.

Top 10 most popular tea varieties

| Tea Type | Market Share | Key Consumers | Growth Rate | Price Range |

| Green Tea | 32% | China, Japan, U.S., Germany | +6.5% | $10–$150 |

| Black Tea | 28% | UK, Russia, Pakistan, India | +3.2% | $3–$60 |

| Matcha | 15% | U.S., Canada, South Korea | +18% | $30–$300 |

| Herbal/Tisanes | 12% | Germany, France, U.S. | +8.7% | $5–$50 |

| Oolong Tea | 6% | China, Taiwan, U.S. | +5.5% | $15–$200 |

| White Tea | 3% | U.S., UAE, Japan | +9% | $20–$250 |

| Pu-erh (Fermented) | 2% | China, Malaysia, U.S. | +12% | $25–$500 |

| Chai (Spiced Tea) | 1.5% | India, Middle East, U.S. | +7% | $8–$40 |

| Rooibos | 0.8% | Germany, Netherlands, U.S. | +6% | $10–$30 |

| Yellow Tea | 0.7% | China, Japan, Luxury Markets | +4% | $50–$400 |

U.S. tea import regulations

For FDA compliance, foreign tea suppliers must register their food facilities unless qualifying as small businesses. Importers must submit prior notice of shipments through the FDA system before arrival. All tea products require proper labeling showing ingredients (including allergens), net weight, and importer contact information.

On customs duties, most true teas (Camellia sinensis) enter duty-free:

-

Black tea (0902.30) and green tea (0902.10) have 0% duty

-

Herbal teas (1212.99) face 0-5% tariffs depending on type

Notable exceptions:

-

Chinese teas still carry 25% additional tariffs under Section 301

-

India and Kenya benefit from duty-free access for black tea

-

Matcha is classified under green tea (duty-free)

Importers should verify both FDA and customs requirements, as herbal blends may face different regulations than traditional teas. The 25% China tariff significantly impacts pricing for pu’er, oolong, and other Chinese varieties compared to similar teas from other origins.

Step-by-Step import process

Step 1: Find Compliant Suppliers

Verify FDA registration (if applicable).

Request lab tests for:

Pesticides (FDA-tested: chlorpyrifos, glyphosate)

Heavy metals (lead, arsenic, cadmium)

Microbial contaminants

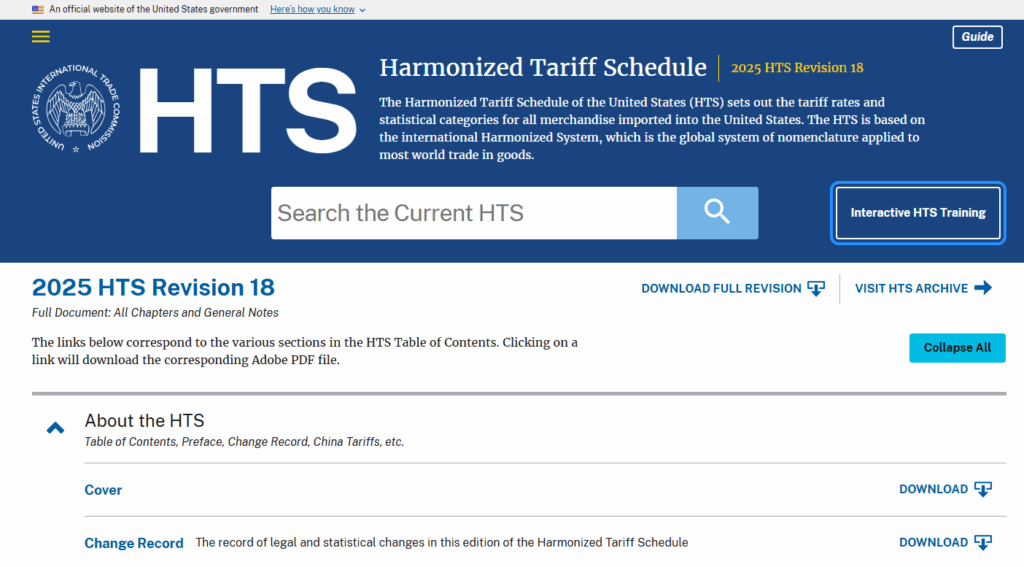

Step 2: Classify your tea (HTS Code)

Use the USITC Tariff Database: https://hts.usitc.gov

Example: Matcha powder = 0902.40.00 (0% duty).

Step 3: Prepare shipping documents

- Commercial Invoice (with HTS code)

- Packing List

- Bill of Lading (BOL)

- Phytosanitary Certificate (for organic/herbal teas)

- FDA Prior Notice Confirmation

Step 4: Clear U.S. Customs

Customs Bond Required (if value > $800)

Possible FDA Inspection (1–5 days hold)

Pay MPF Fee (0.3464% of value, min $27.23)

Cost Breakdown: Example Shipment (1,000 kg Indian Black Tea)

| Cost Factor | Amount (USD) |

| FOB Price (India) | $3,000 |

| Ocean Freight | $800 |

| U.S. Customs Duty | $0 (GSP) |

| FDA Inspection Fee | $200 (if held) |

| Total Landed Cost | $4,000 |

Retail Value (After Markup): $12,000+ (300% profit potential).

Finding and Vetting tea suppliers

The global tea market is booming, but finding trustworthy suppliers requires strategy. This guide covers sourcing channels, due diligence, quality checks, and contract negotiation for importing premium tea in 2025.

Where to find tea suppliers

Online marketplaces

| Platform | Best For | Plus | Cons |

| Alibaba | Bulk orders (China/India) | Large supplier base, Trade Assurance | Risk of fake listings |

| ExportHub | India/Kenya black tea | Pre-vetted exporters | Limited matcha options |

| Tradewheel | Organic/herbal teas | Low MOQs (50kg+) | Newer platform |

| JETRO (Japan) | Matcha, sencha | Government-verified suppliers | High minimum orders |

Tea Trade Shows (2025)

- World Tea Expo– Best for U.S. importers.

- Global Tea Convention (Colombo, Sept 2025) – Focus on Ceylon teas.

- Tea & Coffee Asia (Singapore, Nov 2025) – Southeast Asian suppliers.

Direct Sourcing Options

Tea Auctions (e.g., Mombasa Auction for Kenyan CTC).

Government Trade Agencies:

India Tea Board (www.teaboard.gov.in)

China Tea Marketing Association (https://en.ctma.com.cn )

Top 5 verified Tea Suppliers (2025)

- AVT Tea (India) – Best for bulk black tea.

- Marukyu Koyamaen (Japan) – Premium matcha.

- Kenya Tea Packers (Ketepa) – Fair-trade CTC.

- Yunnan Sourcing (China) – Pu-erh & oolong.

- Dethlefsen and Balk (Germany) – Organic herbal blends.

Tea import regulations: FDA compliance and requirements

The U.S. Food and Drug Administration (FDA) regulates tea imports under the Federal Food, Drug, and Cosmetic Act (FD&C Act). Failure to comply can lead to detentions, rejections, or import bans. This guide covers 2025 FDA rules, including registration, labeling, inspections, and how to avoid costly delays.

FDA Food Facility Registration (FFR) – Who Needs to Register?

- Foreign tea suppliers manufacturing, processing, or packaging tea for U.S. consumption.

- U.S. importers if they modify the tea (e.g., repackaging, blending).

- Exemptions

- Small businesses (if annual sales less than $1M and sold directly to consumers).

- Farms (only growing, not processing tea).

- Prior Notice Submission (PN)

Must be filed at least 2 hours before arrival (for truck/air shipments).

Required for all FDA-regulated foods, including tea.

How to Submit

Use FDA’s Prior Notice System Interface (PNSI).

Work with a customs broker for automated filings.

FDA Labeling Requirements for tea (2025 Updates)

Mandatory Label Elements

- Product Name (e.g., “Green Tea,” “Herbal Chamomile Tea”)

- Net Weight

- Ingredient List

- Allergens

- Importer/Distributor Info

Food Contact Substances (FCS) Compliance

- Tea packaging must meet FDA 21 CFR 175.300 for food safety:

- Tea bags: Avoid nylon/PLA plastics (banned in EU, under FDA review).

- Loose-leaf tins: Must use food-grade liners.

FDA Detention and Refusal Procedures

Common Reasons for Detention

- Pesticide residues (e.g., chlorpyrifos, glyphosate).

- Heavy metals.

- Undeclared allergens.

- Missing Prior Notice.

What Happens If Detained?

FDA issues “Notice of Detention”.

You have 10 days to respond:

- Submit lab tests proving safety.

- Request reconditioning (e.g., relabeling).

- Appeal via FDA Import Refusal Report (IRR).

If unresolved: Tea is destroyed or re-exported.

Understanding tea grades and quality standards

Understanding tea grades and quality parameters ensures you source premium products. This guide explains global grading systems and certifications for importers and connoisseurs.

Black Tea Grading (Orthodox and CTC)

| Grade | Description | Examples |

| OP (Orange Pekoe) | Long, wiry whole leaves | High-grown Ceylon, Darjeeling |

| BOP (Broken Orange Pekoe) | Smaller broken leaves | Assam BOP, Kenyan BOP |

| FOP (Flowery Orange Pekoe) | Leaf + bud, floral notes | Nepalese FOP |

| GFOP (Golden FOP) | FOP with golden tips | Premium Darjeeling GFOP |

| CTC (Crush-Tear-Curl) | Granulated, bold flavor | Kenyan CTC, Masala Chai blends |

Green Tea Grading (Japan and China)

| Grade | Description |

| Sencha (Japan) | Steamed, grassy flavor |

| Gyokuro (Japan) | Shade-grown, umami-rich |

| Longjing (China) | Pan-fired, flat leaves |

| Matcha (Japan) | Stone-ground, ceremonial/culinary grades |

How to assess tea quality

Visual Inspection

| Indicator | High Quality | Low Quality |

| Leaf Integrity | Whole, unbroken leaves | Crushed, dusty fragments |

| Color | Vibrant (green/matcha = bright) | Dull, brownish (oxidized) |

| Buds Present | Golden/white tips | Few or none |

Aroma Test

Dry Leaf: Fresh, floral (jasmine), or malty (Assam).

Red Flag: Musty (poor storage) or smoky (over-firing).

Brewed Color

Black Tea: Bright amber (not murky).

Matcha: Vibrant jade green (not brownish).

Taste and liquor evaluation

| Tea Type | Ideal Flavor Profile | Defects |

| Black | Bold, brisk, no bitterness | Burnt, overly astringent |

| Green | Vegetal, sweet, no grassiness | Fishy (low-grade matcha) |

| Oolong | Complex, floral/toasty | Flat, metallic |

Organic Certification

| Standard | Region | Key Requirements |

| USDA Organic | USA | No synthetic pesticides |

| EU Organic | Europe | Soil health monitoring |

| JAS Organic | Japan | Strict residue limits |

Navigating Customs and Import Documentation

Importing tea into the U.S. requires precise paperwork to avoid FDA holds, customs delays, or rejections. In this guide you can find an information about mandatory documents, clearance steps, and how to prevent costly holdups.

| Document | Purpose | Who Provides It? | Key Details |

| Commercial Invoice | Declares value, HTS code, and product details | Exporter/Supplier | Must include:

– FDA-compliant tea description – FOB/CIF value – HTS code (e.g., 0902.30 for black tea) |

| Bill of Lading (BOL) | Proof of shipment (air/sea waybill for air freight) | Shipping Carrier (Maersk, DHL) | Ensure “Tea” is clearly listed (not just “food”) |

| Packing List | Itemizes contents, weights, and packaging | Exporter | Match exactly with the commercial invoice |

| Certificate of Origin | Confirms tea’s country of origin for tariffs | Exporter/Chamber of Commerce | Needed for FTA claims |

| FDA Prior Notice | Mandatory submission before tea arrives in the U.S. | Importer/Broker | File via FDA PNSI ≥2 hrs before arrival |

| Customs Bond | Guarantees duty payments (required for shipments less than $800) | Surety Company/Broker | Single-entry (per shipment) or continuous (annual) |

| Phytosanitary Certificate | Ensures tea is pest-free (required for organic/loose-leaf) | Export Country’s Agriculture Dept. | Common for China, India, Kenya teas |

| Lab Test Reports | Proves compliance with FDA pesticide/heavy metal limits | Third-Party Lab (Eurofins, SGS) | Test for chlorpyrifos, lead, aflatoxins |

Step-by-Step Customs Clearance Process

Step 1: Pre-Shipment Prep

Supplier provides pro forma invoice → Confirm HTS code and FDA rules.

Book a FDA-compliant freight forwarder (e.g., Flexport, FedEx Trade Networks).

Step 2: Submit ISF (Importer Security Filing)

Required for ocean shipments only (10+2 data elements).

File 24+ hours before loading via ACE portal.

Includes:

- Seller/buyer info

- HTS code

- Container stuffing location

Step 3: FDA Prior Notice Submission

Submit ≥2 hours before arrival (for air/truck).

Include:

FDA product code (e.g., “Tea – 009”)

Manufacturer registration

Step 4: Customs Inspection and Release

Automated Review (ACE System): 70% of shipments clear instantly.

FDA Exam (If Selected): Checks for:

- Label compliance

- Pesticide residues

- Adulteration

CBP Exam (If Selected): Verifies HTS code and value.

Step 5: Duty Payment and Delivery

Pay duties + MPF (0.3464% of value).

Tea released to warehouse (hold time: 1–5 days if no issues).

Calculating Tea Import Costs: Duties, Taxes, and Fees

First, customs duty applies based on the tea’s HTS code (like 0902.30 for black tea). Some teas enter duty-free under trade programs—for example, Indian black tea often has 0% duty under GSP. But if you’re importing Chinese tea, expect an extra 25% Section 301 tariff.

Then come mandatory fees:

-

A merchandise processing fee (MPF) of 0.3464% of your shipment’s value

-

For ocean shipments, a 0.125% harbor maintenance fee (HMF)

-

An FDA prior notice fee (around $100-$200) for food imports

-

A customs bond (roughly $100-$500/year) if your shipment exceeds $800

Shipping costs (air or ocean freight plus insurance) and your U.S. state’s sales tax get added last.

Example:

1,000 kg of Indian black tea valued at $5,000 (CIF) would cost:

-

$0 duty (GSP benefit)

-

$17.32 MPF (0.3464% of $5,000)

-

$6.25 HMF if shipped by ocean

-

~$150 FDA filing

-

Plus bond, freight, and state tax

Total landed cost? Around $5,200-$5,500 before sales tax. Always check current HTS codes—small classification errors can trigger unexpected fees.

Shipping Method: Ocean (40ft container)

| Fee Type | Calculation | Amount |

| Customs Duty | $5,000 × 0% (GSP benefit) | $0 |

| MPF | $5,000 × 0.3464% | $17.32 |

| HMF | $5,000 × 0.125% | $6.25 |

| Shipping Cost | Mumbai → Los Angeles | $1,200 |

| Customs Bond | Annual continuous bond | $150 (prorated) |

| CA Sales Tax | ($5,000 + $1,200) × 7.25% | $449.50 |

| Total Landed Cost | Sum of all above | $6,823.07 |

Retail Value (After 300% Markup): $20,469+

Tools to calculate tea import costs

Duty Calculators

CBP Duty Estimator: https://www.cbp.gov

SimplyDuty: https://www.simplyduty.com (Includes trade agreements)

Shipping Cost Estimators

Freightos: https://www.freightos.com (Compares air/ocean rates)

Logistics of tea importing: Shipping and transportation

Let’s cover different shipping methods, discuss the pros and cons of each option and offer tips for optimizing logistics.

Shipping methods for tea imports

Sea Freight (Best for Bulk Orders)

Pluses:

- Cost-effective (~70% cheaper than air)

- Ideal for full container loads (FCL) (20ft or 40ft)

- Better for non-perishable teas (black, pu-erh, oolong)

Minuses:

- Slow (30–45 days Asia → U.S.)

- Climate risks (humidity, container heat)

- Port congestion delays

Best For:

- Large orders (1,000+ kg)

- Non-urgent shipments

Air Freight (Best for Premium/Fresh Teas)

Pluses:

- Fast (3–7 days door-to-door)

- Lower risk of moisture damage

- Preferred for matcha, green tea, white tea

Minuses:

- Expensive (5–10x sea freight)

- Weight limits (usually less than 500 kg)

Best For:

- High-value teas (matcha, gyokuro)

- Small batches (less than 500 kg)

Land Freight (For Canada/Mexico Imports)

- Trucking: 2–5 days (USMCA countries)

- Rail: Cheaper but slower (e.g., Mexican teas to Texas)

Warehousing and domestic transportation

| Type | Cost | Best For |

| Bonded Warehouse | $0.50–$1.50/kg/month | Avoiding duties until sale |

| 3PL Fulfillment | $2–$5/kg/month | E-commerce sellers |

| Self-Storage | $0.30–$0.80/kg/month | Large importers |

Domestic Transportation

- LTL (Less Than Truckload): For small orders.

- FTL (Full Truckload): For palletized tea.

- Refrigerated Trucks: Needed for matcha (prevent oxidation).

Optimizing Tea Logistics (2025 Tips)

Reduce Shipping Costs

Consolidate shipments (LCL instead of air for small orders).

Use hybrid shipping (sea + last-mile air for faster delivery).

Prevent Damage

Vacuum-seal matcha/white tea to block moisture.

Use desiccants in black/oolong tea containers.

Avoid Delays

Book ships 8+ weeks early (peak season congestion).

Choose FDA-approved warehouses for faster clearance.

Sustainability

Carbon-neutral shipping (Maersk ECO Delivery).

Recyclable packaging (avoid PLA tea bags).

Country-Specific guides for tea importing (e.g., China, India, Japan)

Each tea-producing country has unique regulations, cultural practices, and export challenges. Below you can see a guides for importing from China, India, Japan, Kenya, and Sri Lanka. These countries are the top tea sources for U.S. buyers.

Importing Tea from China

Products

- Green tea (Longjing, Biluochun)

- Oolong (Tieguanyin, Da Hong Pao)

- Pu-erh (Aged raw/Sheng, Ripe/Shou)

- White tea (Silver Needle, White Peony)

Regulations and Challenges

Section 301 Tariff: 25% duty on Chinese teas (exemptions rare).

FDA Scrutiny: Heavy pesticide testing (chlorpyrifos, acetamiprid).

Export Bans: Some aged pu-erh restricted as “cultural heritage.”

Best Practices

- Source from Yunnan/Fujian (most reputable farms).

- Request CNCA organic certs (for USDA organic compliance).

- Use Hong Kong/Taiwan re-exporters to avoid tariffs.

Cultural Nuance

- Negotiate face-to-face (guanxi relationships matter).

- Avoid spring 2025 shipments (Chinese New Year delays).

Importing Tea from India

Products

- Assam black (Malty, bold)

- Darjeeling (Muscatel flavor)

- Nilgiri (Fragrant, smooth)

Regulations and Benefits

- 0% Duty under U.S. GSP program.

- FDA Alerts: Watch for monsoon-season mold (aflatoxin risks).

- FSSAI Export License required for Indian suppliers.

Best Practices

- Buy at auction (Mombasa/Guwahati for best prices).

- Test for glyphosate (common in Assam).

- Ship Oct–Dec (post-monsoon, freshest crop).

Cultural Nuance

- “First flush” Darjeeling (March-April) sells at 3x price.

- Chai blends need cardamom/ginger sourcing (negotiate add-ons).

Importing Tea from Japan

Products

- Matcha (Ceremonial, culinary grades)

- Sencha/Gyokuro (Shade-grown greens)

- Hojicha (Roasted green tea)

Regulations and Costs

- 0% Duty (HTS 0902.10).

- JAS Organic Certification required for “organic” claims.

- Strict Radiation Checks (post-Fukushima FDA testing).

Best Practices

- Order in May (fresh matcha harvest).

- Verify Uji/Kyoto origin (counterfeit “Japanese” matcha exists).

- Use air freight (preserves freshness).

Cultural Nuance

- Ceremonial matcha requires stone-ground proof (e.g., Marukyu Koyamaen).

- Japanese suppliers prefer long-term contracts.

Importing Tea from Kenya

Products

- CTC black tea (Budget-friendly, bold)

- Purple tea (Antioxidant-rich, niche market)

Regulations and Benefits

- 0% Duty under AGOA.

- KTDA Auction: 60% of Kenya’s tea sold here.

- Fair Trade Cert boosts U.S. appeal.

Best Practices

- Buy from KTDA-registered factories (e.g., Ketepa).

- Test for anthrax (rare but flagged by FDA).

- Ship in bulk (costs ~$2.80/kg ocean freight).

Cultural Nuance

- Mombasa port backups common (add +2 weeks buffer).

- “BP1 Grade” = Best for tea bags.

Importing Tea from Sri Lanka

Products

- Ceylon black (High-grown = delicate, low-grown = robust)

- Green tea (Underrated, cheaper than China/Japan)

Regulations and Challenges

- 0% Duty under GSP.

- Economic Crisis: Confirm supplier stability.

- SLS Certification required for export.

Best Practices

- Buy “OP1” grades (long leaf, premium).

- Avoid July–Aug shipments (monsoon delays).

- Check for fake “Ceylon” tea (some blends mix Indian/Kenyan).

Cultural Nuance

- “Single-estate” teas (e.g., Dimbula) command 50%+ premium.

Actionable Tips

- China: Use Taiwanese intermediaries to bypass tariffs.

- India: Demand FSSAI license copies from suppliers.

- Japan: Test for cesium-137 (FDA may screen).

- Kenya: Buy direct from KTDA (not middlemen).

- Sri Lanka: Insist on Ceylon Tea Board logo on packs.

How to import tea to the USA – general questions

What are the key steps for importing tea?

Which countries are best for sourcing tea?

What documents are required?

How much does tea importation cost?

What challenges should importers expect in 2025?

List of references:

https://www.trademap.org/Index.aspx